Bitcoin: what is the price of freedom?

“The cost of Freedom is always high, but Americans have always paid it. And one path we shall never choose, and that is the path of surrender, or submission.”

-JFK

I will explain how Bitcoin empowers the sovereign individual to be free of oppressive government regimes, centralized services and banks which seek to subvert individual liberty, and ultimately allow the individual to consent to a system of governance. This essay will start off more abstract about the nature of money, debt, governance, and consensus and gradually focus in on bitcoin its technical details and bitcoin as an investment. In order to understand the future bitcoin can help us achieve, it’s necessarily to understand the nature of reality and the problems bitcoin will solve.

What is money? Why do we need gold?

Money is simply a way to transfer value between 2 consenting individuals, there is nothing evil about it. It is ultimately a tool of those who produce, not those who loot. Without goods made by men who produce, there would be no wealth or value to transfer, hence money would be worthless. As we can see money is an invention of men to allow those who produce value to trade amongst each other. In fact during the ancient times of the romans, greeks, byzantines, etc. when the world ran on the gold standard trade flourished and innovation and invention skyrocketed. Of course each empire have their own currencies and primitive central banks, but they all agree upon gold as the sort of universal currency that could facilitate inter-empire trade, while intra-empire trade was done by local currencies. Each ancient empire ran on a de-facto gold standard. This universal currency makes it so people don't waste their time an effort on currency tricks, arbitrage, or building systems to facilitate trade between empires, you just convert to gold and trade. Bluntly, it makes sure people dont waste their lives in banking and do more engineering and art to drive actual progress.

Money is creation made by man, so there is nothing fundamental preventing man from making more, evidenced by the federal reserves money printer today. Because of this fact, gold acts as a way to store that value you produce through your labor, mind, or combination of the two. Gold rests on the assumption that there is a limited supply, you are paying for scarcity. Roughly 1 share of the dow jones could buy 17 bars of gold in 1970 and today (2020) 1 share of the dow jones can buy 18.5 bars of gold. If you produced enough value for society to earn 1 share of the dow in 1970 gold perserved that value that you created all the way up to today (2020), for the most part. The same can't be said for the dollar. In fact 1 share of the dow jones in 1970 was roughly 700 dollars, today its around 33,000 dollars.

We have established money is an invention based on nothing but belief that is used for trade. In fact the US dollar has "In god we trust" printed on every dollar bill. Money is a belief system and the more people that adopt your belief system the more valuable your money is because the more people you can trade with. However, because money isn't good to preserve value, people adopted gold into the Religion of money.

Central banks: Monopoly on money or Monopoly money

Central banks control the supply of money. They essentially set the price of money, wether it takes 1 dollar to buy a loaf of bread of 5 dollars. Thats a monopoly on the price of money. They ask us to trust them as benevolent dictators who act to stabilize prices and maximize employment. Well this is starting to sound like central planning and for my non-history buffs, centrally planned economies are clocking a 0% success rate in all of recorded history and millions in the grave, but hey the Harvard and Yale PhDs could finally make it work.

The formula ( called Modern monetary theory, MMT) is something like this:

When there is a recession make money cheap by cutting rates and printing money so businesses will use it to stimulate the economy by artificially hiring people to create more supply of their products on the hope that demand will bounce back and then we will reach a steady state.

I'll just say its called a theory for a reason, however academic hacks are too insulated from reality to notice its not working. Taxpayers fund them too opine on issues with their 'research' publications and wonder why all the universities professors range from raging marxist to democrat socialist and reject any idea that is right of Stalin.

The problem is 2 fold. First you can't make people artificially demand things. Value is ultimately subjective and determined by humans, if there are a million Prius cars but no one is buying them making 2 million isn't going to magically cause people to desire them. The 2nd problem is the federal reserve tries to allocate this money into the economy, but does so by funding zombie companies and unproductive assets. Imagine building more stables on the road for horses in 2020, pretty stupid because we all drive cars. Thats what I mean by unproductive assets and zombie companies. A more modern example would be funding Ford over Tesla, or investing in brick and mortar retail over e-commerce.

However, the Federal reserve is always unable to raise rates back to their previous level and stop printing money before the next recession occurs. The evidence is rates have gone from 16% around 1980 to 0% today and the federal debt is exponentially increasing because of our uncontrolled spending. Biden has proposed 12-14 Trillion of new spending in his first 3 months. That's 2 trillion roughly everyone other week. A trillion here and a trillion there and eventually you're talking about real money. To be fair republicans under Trump did print about 4 Trillion. At this point it's like asking choosing where you want to be shot: the head by democrats or the foot by republicans. Could bitcoin be a 3rd option, keep reading to find out.

The result of the federal reserves monopolistic pricing of money has partially enabled past systemic crises and will ensure the growth of future imbalance and excess. This is what has enabled the gross misallocation of capital, the effects of which are most glaringly obvious in the negative real interest rates offered in sovereign debt markets.

Wait is this real life or are we just playing monopoly? Can't the banker just keeping giving us more money?

The conclusion of the long term debt cycle

The long term debt cycle is the conclusion of all the short term debt cycles. Each recession or short term debt adds more leverage to the system until it all ends in some sort of depression. Since the 1930's Great Depression, the conclusion of the last long term debt cycle, debt has looked like a sin wave with a linear trend where as a normal healthy economy would look like a sin wave around the x axis. What I mean is its healthy when things get over leverage to let leverage clear itself out of the system. This preserves the natural boom / bust nature of the economy and of life really.

However, by popular demand, we have told the government and from that the federal reserve we dont want busts or suffering. A natural thought want, but we can't eliminate all suffering with financial tricks. Eliminating suffering is only possible through technology and not here yet, although I'm cautious optimistic about of future, we cannot spare humans suffering. Then there is the philosophical tangent that suffering gives life meaning, another time perhaps.

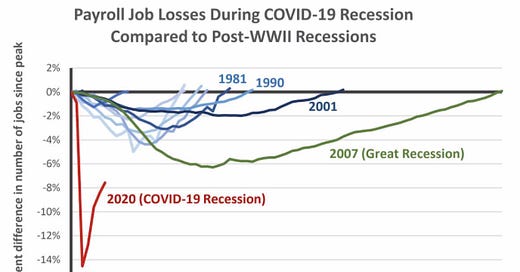

Excess leverage in a system makes it incredibly fragile. Imagine a Jenga tower at the beginning of the game (low leverage) and a Jenga tower at the end of the game (high leverage). You can see this as each recession since 1930 has been successively worse and longer (see image at the bottom of this section). This is because you are fundamentally borrowing against the future to accelerate the future, it the future doesn't come to pass like you planned someone's got to foot the bill. Today leverage (debt) is at all time highs and reaching new all times highs each day, rates are at zero, and the printed money is invested in bailing out non-productive dead assets or zombie companies like brick and mortar retail, Ford, or GM. You bet the future on brick and mortar while its clear people value e-commerce.

Theres only 3 ways out of this. One force people to like ford cars over Tesla's and to shop at malls instead of on Amazon. This is impossible because you can't tell people what to value, its up to them to decide. Second you could stop printing money and raise rates to wipe out all the leverage, which would crash the economy and put us into a depression. This would cause riots and politicians to lose their jobs so they won't do this. Third and the inevitable option is to continue more of the same, print money to inflate the debt away while hopefully keeping the economy somewhat stable. Politicians will do the third, unless they turn full on communist centrally planned economies and tell us what to buy. Inflating the debt away via massive money printing has lots of downstream effects. By the way this is just the government looting value from all of society which worked to produce it. As I said, nothing is free, everything has a cost.

First as money is inflated to be worth nothing by the monopolistic federal reserve, people will rush to put their money in assets (stocks, housing, etc). They will temporarily suspend belief in systems like a DCF analysis and pretty much pay whatever price for any asset as they seek to buy scarcity. DCF analysis relies on a fundamental assumption of sound / stable money, so when that assumption is false, a DCF is worthless. Stocks and houses are imperfect solutions to scarcity but an okay proxy. By the way, good luck to any young person saving to buy a house during these times, government has screwed you once again, but hey blame in on evil billionaires and white supremacists, you'll feel like you accomplished something. Next savers are punished, this one is obvious. This forces everyone to turn into investors and not just any value investor, but high growth investors. If the money supply is increasing at 10-15% a year, if your stock or house is not growing by at least that much, you are losing purchasing power. More speculation that the gold rush is occurring. Its why the market is throwing a 50-100 price to sales ratio on anything with an ounce of potential.

In hindsight, the longterm debt cycle could only end in one way, it was inevitable.

Decentralization & censorship, Mob rule of the 51%, and consensus protocols

The private companies can do whatever they want debate misses a lot of points. The constitution provides inalienable rights given to you at birth by god that no government or company should be able to subvert. The government’s sole reason for existence is to protect those rights from foreign threats (Communists and China) and from internal threats like monopolistic companies that start to act as quasi governments (Facebook, Twitter). When twitter made the decision to ban Trump from its platform, if you can silence the king, you are the king. This is a subversion of your first amendment right to speech. The public square has be digitized and so has your first amendment right. We agree social media would be much better if decentralized. No one, private company or government should have that power to censor what they deem unfit. Likewise, why should any one entity have power over the price of money.

Banks have the same monopolistic power. The US dollar is a weapon the US uses against its enemies from freezing Japans bank accounts pre WW2 to sanctioning Iran by freezing their accounts today. The dollar is the de facto currency for oil trade and the reserve currency of the world thanks to Brenton Woods decree. It's called fiat for a reason, Brenton Woods is a decree enforced by the once strong US and our military. This has allowed the US to make the world pay for its debts by artificially increasing demand for the dollar. The weaponization of the dollar has allowed the US to enjoy unprecedented strength on the global stage, however the bill is coming due. The world is moving off oil thanks to the environmental movement, globalization is in retreat, and countries are not buying our debt anymore. If our government can't even run our country successfully, they have no moral authority to tell other countries what to do and other countries, like China, are increasingly calling our bluff. China has even moved to make the yuan the unit of trade of East Asia.

Further, if the US could weaponize the dollar against other countries, why could the US not use these systems on its own citizens, words are empty promises, our government has show to be unfathomably corrupt time and time again. What happens if one of the big four banks deems you less worthy, freezes your accounts, takes your funds, its all entries in a centralized database after all. Where is your court of appeals? do they have to show due process or can they just wipe you out no reason needed?

You can make the case, you should trust our government. I think its incredibly stupid and short sighted. When your government is increasingly advocating for policies like book banning, mass deplatforming, and creating a truth czar to tell the public what is false information and what isn't it's time to come back to reality. If you find yourselves trusting that entity or worse yet advocating for it, it's really time for some soul searching.

Decentralization fundamentally solves the problem of trust. the systems of governance are designed in a way that it requires 100% consensus, there is no single point of failure and there is no single person in charge.

Did anyone ever get a vote or even consent to MMT, the federal reserves policies, or any of the policies involving the dollar. Democracy is a garbage political system and the only one the founding fathers were ardently opposed to. This is because its mob rule by the 51%. Bitcoin and crypto solves this because its opt in. You dont like it trade your crypto to another one you like or don't buy it. Today if I disapprove of the federal reserve and what they are doing with the dollar, what choice do I have. Can you honestly say its simple just to convert all your dollars to Swiss franc. How do I even open a Swiss account? what it they have currency controls to lock me in? what if the US government doesn't allow me to leave the US dollar system? In crypto land, you never have to ask permission to do something and if you are unhappy you can simply exit. Today in the current US political and monetary system, there is no exit. They have a monopoly that has effectively trapped you in the system and while once they may have been good, they are using their monopoly power to deliver an increasingly worse experience while charging you more for it.

To this I say au revoir, and welcome to the age of blockchains and decentralized consensus protocol or cryptoland.

The solution: purchase Bitcoin, purchase freedom

Bitcoin is a digital store of value that empowers the sovereign individual. Bitcoin is a truly free market. Boom and bust cycles are allowed to happen, bear markets are not outlawed, markets don't react to one person like modern markets react to the current fed chairman or oracle of Delphi, excess leverage can get wiped out of the system from time to time. This is good. This will allow value businesses that produce stable cashflow to actually be properly valued in the market, instead of forcing everyone to be a high grow investor. It reintroduces the idea of risk capital. it will stop longterm debt cycles from blowing up the world. It will actually allow people to save for retirement and not be forced to invest in risky assets or work until they die. Bitcoin is cryptographically secures value you produce from those who desire to loot it like the government. You can work 10 years store that value to use over the next 10 years without any fear it will be worth less than when you produced it.

Why Bitcoin disrupts gold and sovereign treasuries, the TAM

The opportunity with bitcoin is essentially buying money before it becomes money. Once it becomes the global reserve currency it will reach a steady state like the dollar where a dollar is simply a dollar. A bitcoin will simply be a bitcoin. The value will stabilized and it will be the new base layer for the global monetary system.

Gold is hard to verify, hard to store and protect, very hard to transport, and impossible to divide. Here is what makes bitcoin great. The source code for bitcoin is open source, anyone can view and inspect it on GitHub. Every block on the blockchain is verified by mathematical proof of work algorithms, which everyone can individually verify by running their own node. In fact, Bitcoin is the most scrutinized project in the world. Bitcoin is easy to store, protect, and transport because all you have to do is memorize your private keys or a password if you use an exchange or like kind service. Bitcoin can be divided 100 million different ways, since each Bitcoin is worth 100 million satoshis. Bitcoin is permissionless, if you can access the internet, you can use bitcoin and spend it, however you so choose. Bitcoin is universal, since it is decentralized every country will adopt and accept it because they dont have to trust each other, they just trust math. To secure the network each country will run their own nodes. Because anyone can run a node and all nodes run the same algorithm, you can't censor it. Fundamentally you can only take down bitcoin if you take down the entire global internet and wipe every hard drive that stores the bitcoin blockchain. Unlikely to the point of practically impossible.

All the money that currently uses gold, stocks, houses, or other assets as a proxy for a store of value will eventually find its way to bitcoin. The gold market is currently 10 trillion dollars. Fundamentally bitcoin is a digital version of its gold analog and there is no time where a digital product that delivers a 10x improvement on its analog isn't worth more. So if bitcoin only captures 2x of that 10x improvement it will get to a minimum of 20 Trillion in market cap. The entire bond market full of sovereign nations treasury bonds are ultimately acting as a proxy for a store of value because nations dont collapse but once every century maybe. Eventually as people realize how corrupt central banks are they will move that money in sovereign treasuries to bitcoin which is worth another 50 Trillion minimum. Ultimately the market for money is 300 Trillion and bitcoin is good enough right now to hold all that monetary energy.

Reflexive feedback loops

Bitcoin is the one crypto to rule them all because, its the only one with a fixed supply, truly decentralized as there is no one driving the project like Vitalik with Etherum, and it is the biggest. If you understand money you understand there can only be one. Why would someone want a currency that has less adoption hence less trade potential. Bitcoin is the biggest by market cap and user base. This will attract more buyers and institutions, which will make the price go up, and the cycle repeats as more people are attracted because they don't to miss out. As it gets bigger it gets more stable, it becomes hard for a few billion in trades to swing the price a lot when the market is worth a couple trillion. This is reflexivity at work. Bitcoin is a religion, but a religion which is based on proof of work. This will encourage adoption because there is proof. As you adopt the religion you become part of a conspiracy to change the world and economically incentivized to become a missionary for the church of Bitcoin, as another member learns the secret they become part of your conspiracy to change the world. As I said above, money and value is all fundamentally a consensus of subjective belief by humans. Reality is a consensus game, truth is misleading. This is why money succeeds, and why Bitcoin is inevitable.

Cons

Bitcoin fundamentally solves one problem, being a store of value like gold was in ancient times. The rest of the monetary system can be built around that. Etherum and other project will have lots of value and be important, but they are solving fundamentally different problems than bitcoin. However, DeFi deserves another essay about how it is restoring the promise of a truly peer to peer internet.

The one big coin is if China decided to continuing mining, but not publish its bitcoin blockchain. There are ways around this, like forking, and fundamentally, you want a currency with the max potential for trade. Hence, no entity would act malevolently because then other nations would ignore them and the trading potential of their holdings goes down.

Finally, if you dont like Bitcoin fork the chain, make your own. Its a consensus game and if you dont agree the cost of exit has never been cheaper.

Decentralization is your duty as an American

As America continued to expand west into the final frontier, self-sufficiency and decentralized means of production continued to be important, and indeed, they have been central to our growth and continued success. As the years have passed, power has become centralized in both government and industry. The effects of this were starkly on display through 2020 and will continue to reverberate for years to come. The weakness that results from our heavy reliance on critical goods from global sources, particularly from China, the arbitrary and—in my opinion—unconstitutional power seizure by central government agencies, tyrannical orders by governors, and unchecked market manipulation by the Federal Reserve have contributed to a larger awakening of the need to return to our roots and reclaim those natural rights.

Bitcoin wants you, and it would be ever so rude to deny her.